amazon flex taxes canada

Hourly rate plus per package full family benefits and a pension that pays 60 of your wage for life after 20 years. That means you have to pay self-employment tax.

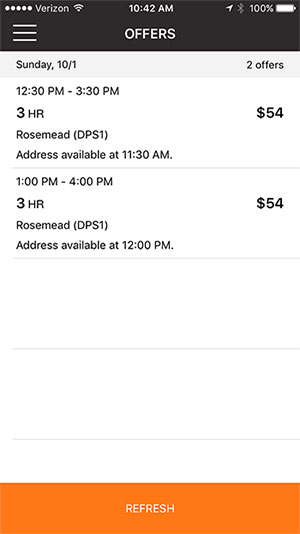

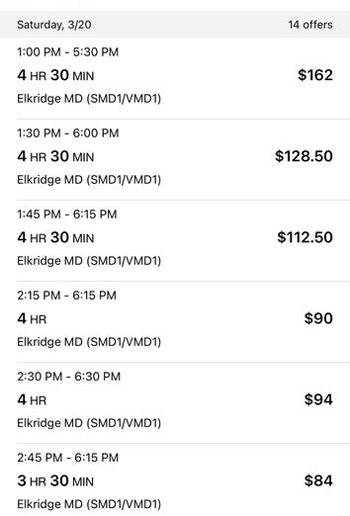

Pickups from local stores in blocks of 2 to 4 hours.

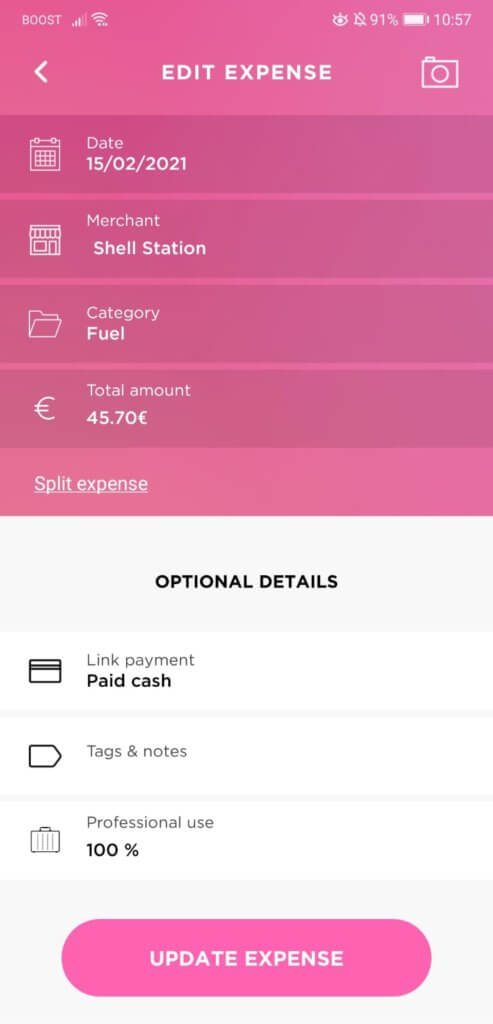

. Selling on Amazon SoA and advertising fees are typically subject to taxes where the seller is. Report Inappropriate Content. Youll need to record the number of miles you do keeping a detailed log of where you have travelled and then claim the set amount by HMRC.

Under Canada tax jurisdictions settings add your Canada tax registrations numbers to activate each of them. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. Increase Your Earnings.

We are actively recruiting in. Knowing your tax write offs can be a good way to keep that income in your pocket. Gig Economy Masters Course.

AWS Canada is registered for Canadian Goods and Services Tax GSTHarmonized Sales Tax HST Quebec Sales Tax QST British Columbia Provincial Sales Tax BC PST Manitoba Retail Sales Tax MB RST and Saskatchewan Provincial Sales Tax SK PST. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. Getting started with Amazon Flex Rewards is easytheres no signup required.

Fill out your Schedule C. The rates are currently 45p for the first 10000 miles of driving. Amazon will not withhold taxes on the earnings of Canadian tax residents.

Make CAD 22-27hour delivering packages with Amazon. Schedule C will have your business income and expenses. Only available in limited areas these deliveries start near your current location and last from 15 to 45 minutes.

Select Sign in with Amazon. Go to your phones My Files or Downloads folder and tap the Amazon Flex icon to install. Be your own boss.

As an independent contractor. Amazon flex business code. Canada Fulfilment by Amazon FBA service fees are subject to Canadian sales tax at the tax rate of the fulfilment centre providing fulfilment services regardless of your business location.

From Settings select Tax settings. With Amazon Flex you work only when you want to. You can plan your week by reserving blocks in advance or picking them each day based on your availability.

The correct business code is 492000 Couriers messengers. Welcome to Amazon Flex an innovative new service offering you the opportunity to deliver Amazon packages through the Amazon Flex app. Claiming for a Car on Amazon Flex Taxes.

All service fees for fulfillment by Amazon FBA in Canada regardless of location are subject to Canadian sales tax if any at the same tax rate as the fulfillment centerUnless its an official referral Amazon SoA and advertising fees are usually subject to personal income tax in the state where the seller lives. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. Youre going to get a 1099 and fill out a Schedule C for this.

Tap Forgot password and follow the instructions to receive assistance. If youre NOT simply the author or you were involved in publishing the book or whatever you were getting royalties from then its not as simple as that. Amazon Flex quartly tax payments.

The final number will be the taxable income which will go on your 1040. When prompted tap Trust. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes.

Amazon is excited to welcome you to the Amazon Flex program and hope that you enjoy being your own boss and running your own business by using the Amazon Flex app. With Amazon Flex you work only when you want to. And heres something thats really important.

New Brunswick 15 Newfoundland 15 Nova Scotia 15 Prince Edward Island 15 When you make a sale on Amazonca you may be required to register collect and remit GSTHST andor PSTRSTQST even if you do not have a physical presence in Canada or a particular province. In Canada flex drivers are employees by law and can unionize. The mileage deduction is one of those expenses.

Go to Settings General Profiles or Device Management. Most people pay 153 in self-employment tax. Your 1099-NEC isnt the only tax form youll use to file.

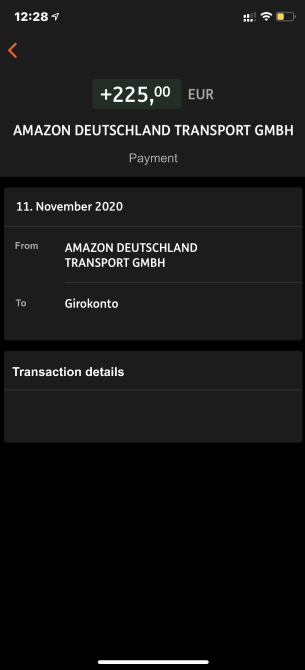

You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Amazon Flex drivers can make about 18 to 25 per hour. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Amazon Flex drivers are independent contractors. Unfortunately youll still have to report your income to the IRS even without a 1099. The 153 self employed SE Tax is to pay both the employer part and employee.

Turn on Location Settings. Louis MO Boston MA Cincinnati OH Salt Lake City UT. Amazon Flex is a program where independent contractors called delivery partners deliver Amazon orders.

Driving for Amazon flex can be a good way to earn supplemental income. Sign out of the Amazon Flex app. Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes.

After October 1 2021 AWS Canada will issue tax compliant invoices for all. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Self-employment taxes include Social Security and Medicare taxes.

Activate your Federal Goods and ServicesHarmonized Sales Tax GSTHST Enter your GSTHST registration number. You simply earn points by completing blocks and making. If you use an iPhone set up trust for the app.

If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive. If youre an author and some other entity is the publisher then you commonly declare a royalty on the line for foreign income line 10400 for this years tax return. Disable or uninstall any app that changes the lighting on your phone based on the time of day.

Make more time for whatever drives you. The standard deduction is against your taxable income on your 1040. Ad We know how valuable your time is.

Whats the downside as union dues are tax deductible. Review the Amazon tax calculation methodology accept then click Continue. Choose the blocks that fit your schedule then get back to living your life.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Make Money On Amazon In Canada 12 Practical Ways 2022

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Filing Your Taxes Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Flex Menstrual Discs Disposable Period Discs Tampon Pad And Cup Alternative Capacity Of 3 Super Tampons Hsa Or Fsa Eligible Made In Canada 12 Count Amazon Ca Health Personal Care

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Gst Number For Doing Amazon Flex In Canada R Amazonflexdrivers

How To Do Taxes For Amazon Flex Youtube

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable